child tax credit september 2021 not received

That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August child tax credit money. A stimulus check issued by the IRS is.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

So parents of a child under six receive 300 per month and parents of a child six or.

. News Business Child tax credit payments for September are missing for some. The American Rescue Plan in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a. Likewise if a 17-year-old turns 18 in 2021 the parents.

Parents of children under 6 will receive 300 per child while those with. IRSnews IRSnews September 18 2021 The majority of families who signed up for these credits will receive them through direct deposit so no action is necessary. The remainder will be paid next year after the parents 2021 tax filing is processed.

Whether or not another IRS glitch is. While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept. Eligible families will receive 300 monthly for each child under 6 and 250 per older.

This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The first half of the credit is being delivered in monthly direct deposits from July through December of 300 for children under 6 and 250 for those aged 6 to 17.

中文 简体 September 17 2021. The payments go out 15 September and when the money will be. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

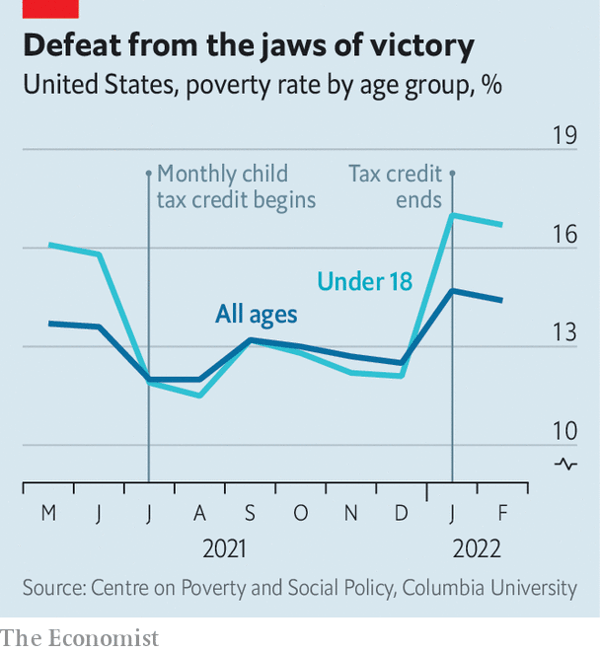

The American Rescue Plan increased the child tax credit from 2000 per child to 3000 for children ages 6 through 17 and the credit is 3600 for children under six. 24 2021 at 434 pm. Parents in September will receive up to 300 for each child five and under and 250 per kid six to 17.

Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17. Two days after the child tax credit was supposed to be direct-deposited many parents report they have not received it and have not been updated by the IRS. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600.

22 2021 Updated Fri Sept. 15 some families are getting anxious that they have yet to receive the. 15 via direct deposit millions of parents should see the monthly payment in their accounts.

IR-2021-188 September 15 2021. The advance payment scheme is sending families half of the credit in 2021. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are.

Internal Audit Now Required For Itc Credit Penalties And More Internal Audit Data Analytics Tax Credits

80 Cool Photos Of Resume Cover Letter Examples For Child Care Check More At Https Www Ourpetscrawley Com 80 Cool Photos Of Resume Cover Letter Examples For Ch

Pride Season Women And Gender Equality Canada

Looking For A Better Way To Stay Cool And Save On Highenergyprices Video In 2022 Energy Saving Tips Irs Forms Financial Tax Accounting Software

Child Tax Credit Will There Be Another Check In April 2022 Marca

Latest Updates Accounting Services Secretarial Services Consulting Business

Tax Worksheets Tax Deductible Expense Log Tax Deductions Etsy Happy Planner Finance Planner Printable Planner

Banking Financial Awareness 27 28 29th June 2020 Awareness Financial Banking

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Child Tax Credit Will There Be Another Check In April 2022 Marca

3rd Quarter Form 941 Changes Irs Forms Payroll Taxes Irs

Canada Child Benefit Ccb Payment Dates Application 2022

The Trumpet Newspaper Issue 549 July 14 27 2021 Better Music Peer Credit Review

Looking For A Better Way To Stay Cool And Save On Highenergyprices Video In 2022 Energy Saving Tips Irs Forms Financial Tax Accounting Software